With fluctuating inflation, energy costs and shifting consumer demand, 2024 will be an unusually turbulent economic climate; compressing working capital cycles by optimising the time between paying suppliers and collecting from customers will be vital for companies to maximise liquidity and build resilience no matter which direction markets trend.

What is the ‘Cash Conversion Cycle’?

The cash conversion cycle is the time it takes for a company to turn its investments in inventory and other resources into cash from sales.

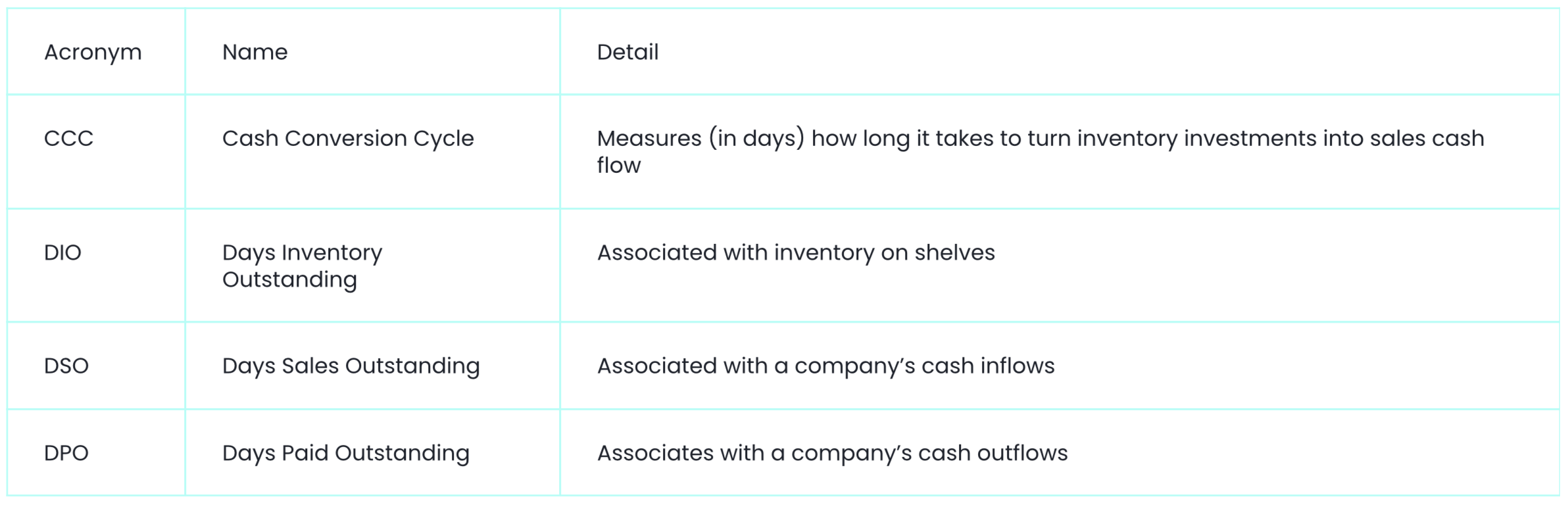

CCC = DIO + DSO – DPO…. Err, say that again?

The cash conversion cycle (CCC) is measured by adding the time it takes to sell inventory, collect receivables, and subtracting the time it takes to pay suppliers, all to gauge how efficiently a company manages its cash flow. The shorter the cycle (# of days) the quicker the cash collection.

A 2022 working capital whitepaper by JP Morgan suggested that the average CCC of S&P500 companies is 69.5 days. According to the Institute of Supply Management, a range of between 30–45 is good (ISM, 2023). At time of writing, Amazon’s was -5 days and Tesla’s was 9 days (GuruFocus, 2024).

Why is this imperative to organisations, finance and procurement folk?

Whilst management accountants usually monitor and control the CCC because it provides a valuable insight into operational efficiency and working capital requirements, procurement professionals also have a part to play.

In the complex world of business operations, the alignment of “Order to Cash” (O2C) and “Purchase to Pay” (P2P) processes might just be a North Star aspiration. Many see supply chain processes as boring back-office functions best left to bean counters. Yet to drive profitable, frictionless operations – leading organisations turn order-to-cash and purchase-to-pay into a dynamic cash flow orchestration.

On one side you have O2C – the coordination of confirmed orders flowing seamlessly into realised revenue. On the other P2P – orchestrating procurement, receiving value and scheduling timely payments. Independent they already demand coordination across teams. Complex global supply networks mean both must align perfectly, lest businesses hear new lyrics like “Late Again” or “Where’s My Stuff?”.

Why should I take a critical look now and what are the benefits?

Forward-thinking companies now take a platform approach to connect O2C and P2P on unified architecture. Order milestones automatically trigger procurement requests. Goods receipts validate accuracy before payments. Invoice-level drill-downs provide transparency from end-to-end. Integrated analytics provide insights to optimise both cycles, while automation eliminates wasted manual efforts.

The Benefits of aligning O2C and P2P:

- Faster Cash Conversion Cycle: When O2C and P2P processes are aligned, there’s a reduction in the time it takes for cash to flow into the business. This accelerated cash conversion cycle boosts liquidity, providing funds for growth and strategic initiatives.

- Enhanced Working Capital Management: Freeing up working capital means less reliance on external financing and improved business health.

- Improved Supplier Relations: When P2P and O2C processes are aligned, both suppliers and customers benefit. Timely payments to suppliers build trust and enhanced working relationships and might even lead to favourable terms or discounts.

- Reduced Operating Costs: Efficient processes lead to lower operational costs. Automated invoice processing with reduced manual interventions and fewer errors also contributes to cost savings.

- Better Decision-Making: When data flows seamlessly between O2C and P2P, decision-makers have a clearer view of the entire supply chain. This insight enables more informed choices, from procurement planning to customer demand forecasting.

Real world examples:

- Flex: The manufacturing services provider consolidated its global O2C and P2P processes on a single cloud platform. Results include 92% touchless invoice reconciliation and reduced days payables outstanding (Flex, 2021)

- Levi Strauss & Co: The apparel company developed an integrated order management system linking inventory planning, supply chain logistics and financial flows. Outcomes include 95% O2C efficiency and lead-time reductions (Levi, 2021).

- Omnicom Group: The advertising conglomerate implemented a common procurement-revenue platform across all agencies globally. This integration drove $186 million in efficiency gains in the first year (Omnicom, 2022).

As PepsiCo’s former CFO Hugh Johnston put it, “The availability of cash, as well as the efficiency of the cash conversion cycle, is highly important to the financial health of the company”. For procurement leaders specifically, the Yin and Yang of orders and payments must balance and if they do, the integration unlocks immense organisational potential.

GET IN TOUCH WITH OUR TEAM TODAY

If you are interested in discussing digital innovation or merely want to collaborate on the topic, then please reach out to Mark Ellis (Partner) and/or Joe Gibson (Head of Digital Innovation).